Explore your home equity options with this comprehensive guide, covering VA Cash-Out refinance, home equity loans and HELOCs. Learn about their distinct features, financial implications and which option might best suit your needs.

There are a number of reasons homeowners want to liquidate some of their home's equity, from bankrolling home improvement projects to paying off higher-interest debt or even funding college tuition.

There are three main home equity options to consider:

When you're considering tapping into your home's equity, it's important to be aware that not all products are created equal. Each option has unique features and considerations.

VA Cash-Out Refinance

One option is the VA Cash-Out refinance. A cash-out refinance is a new loan that pays off your current mortgage, allowing qualified homeowners to extract cash from their equity.

With a VA Cash-Out refinance, qualified homeowners can typically borrow up to 90 percent of their home's value. Because it's a new loan, borrowers are subject to market rates.

Homeowners will need to meet a couple of important VA guidelines if they plan to borrow more than what they owe:

One is a net tangible benefit test that helps ensure the refinance is in the Veteran's best financial interest.

The other is a seasoning guideline. You'll typically need to have made at least six monthly payments on your current loan, and the date of the refinance will usually need to be at least 210 days after the due date for the existing loan's first payment.

Credit and underwriting guidelines for a cash-out refinance look similar to those for a VA purchase transaction, including income and asset verification, credit score benchmark and an appraisal.

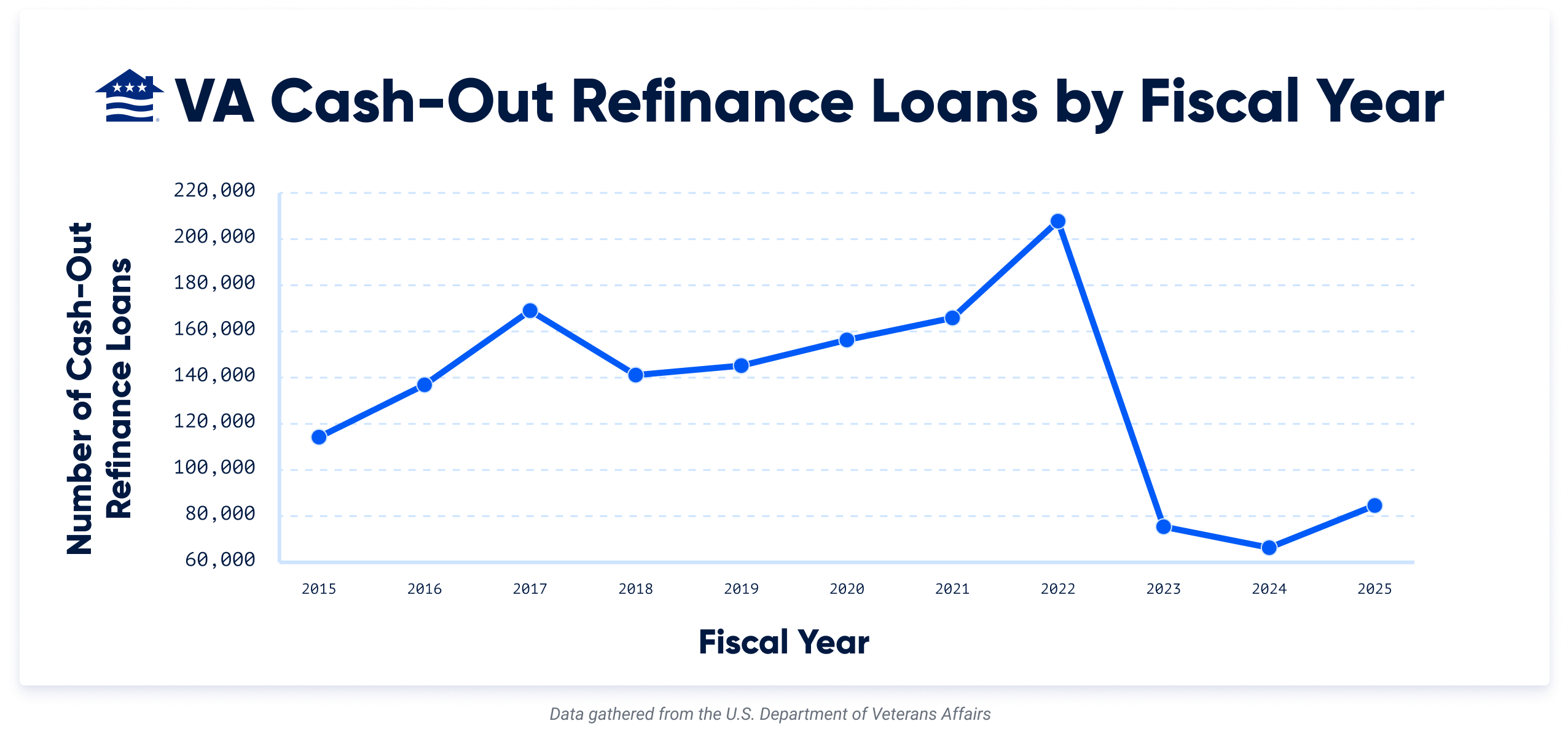

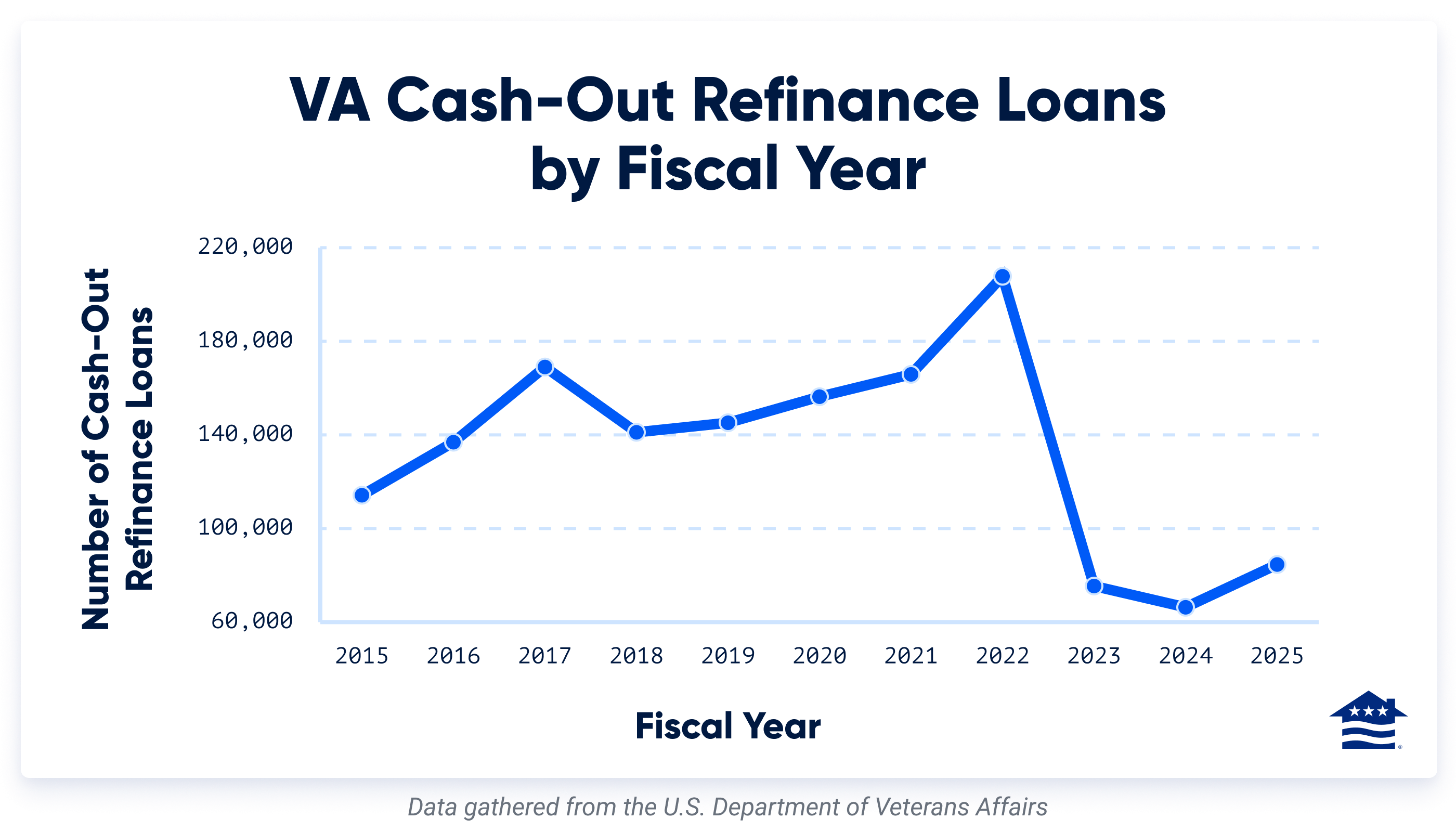

VA data shows more Veterans tapping their equity again. VA Cash-Out refinances rose from about 66,000 loans in FY 2024 to more than 84,000 in FY 2025, a jump of roughly 28%. That growth reflects how many homeowners are choosing this option for debt consolidation, home improvements and other big-ticket goals.

When considering the broader picture, it’s clear that cash-out refinances have become less popular than they were from 2015 to 2022. Many homeowners locked in modern-day low rates during the COVID-19 era, so it often doesn’t make sense to replace a low fixed rate with a new loan at a higher rate just to access equity. But a cash-out refinance can still make sense if the total benefits outweigh the cost, like using equity to pay off high-interest credit cards, fund major repairs, cover big life expenses, or consolidate multiple debts.

A cash-out refi can also make sense if you bought your home in the last few years after rates climbed, since mortgage rates have eased a bit since then following recent Fed rate cuts.

These refinance loans also come with a funding fee. The fee can be financed into the loan, although homeowners taking out cash will still typically need to meet the 90 percent loan-to-value guideline.

Home Equity Loan

A home equity loan shares some similarities with a cash-out refinance. Both are typically fixed-rate products, and they pay out a lump sum at closing. But a home equity loan is a separate loan, which creates a second lien against your property and won't change the rate or term of your first mortgage.

Home equity loans typically feature fixed rates, making it easier to budget for the long term. Since these are separate from your original mortgage, you won't add extra years to your mortgage term. After you close on a home equity loan, you get a lump sum to spend as you choose.

On the downside, interest rates tend to be higher on home equity loans than mortgage rates, and credit score requirements can be more stringent. Home equity loan credit score requirements vary by lender, but lenders typically expect a 660-680 minimum FICO score. Homeowners whose current mortgage rate is higher than today's market rates might want to consider a refinance rather than or in addition to a home equity loan. Savings from a possible refinance could make a big financial difference over the life of the loan.

Home Equity Line of Credit (HELOC)

A home equity line of credit (HELOC) isn't a mortgage loan at all. Instead, it's a line of credit extended by a bank or financial institution that uses your home equity as collateral.

While it won't impact your home loan term or rate, it will create a second lien against your property. Unlike home equity loans and cash-out refinance, a HELOC doesn't pay out a lump sum at closing. Instead, you use your line of credit much like a credit card.

Closing costs on a HELOC are usually lower than a refinance product. HELOCs often have two phases – a draw period where you can tap into your home's equity and a repayment period. Together, these periods typically last anywhere from 15 to 30 years.

HELOC rates are often adjustable, which can make it harder to budget for the payments in the long term. Once the repayment period starts, you can no longer use the line of credit, and your payments (which include principal and interest) are based on your outstanding balance.

Some homeowners use HELOCs to fund longer-term home renovation projects, which can be a good investment, assuming that they are increasing your property's value. And in a true financial emergency, a HELOC can be a better option than higher-interest credit accounts.

As you explore options for borrowing against your home's equity, consider how you plan to spend the money. A VA Cash-Out refinance might be better if you hope to receive a lump sum after closing.

The bottom line is that exploring your options with a trusted expert can help. When you're ready to take the next step, an experienced loan officer can help you understand which product works best for your specific needs.

Does Veterans United Offer Home Equity Loans, HELOCs and VA Cash-Out Refinances?

Veterans United doesn’t offer home equity loans or HELOCs directly, but we can connect you with a trusted partner that offers home equity loans and HELOCs.

Veterans United does directly offer VA Cash-Out refinances. Speak with one of our VA loan experts about your home equity loan, HELOC, or VA Cash-Out refinance options today. It’s always a good idea to weigh your options!

VA Home Equity FAQs

Below are a few common questions about VA home equity options to help you make the most informed decision with confidence.

Is There a VA Home Equity Loan for Veterans?

There is no true VA home equity loan option. Veterans who want to access their home equity for cash should consider a VA Cash-Out refinance loan. Veterans can still get home equity loans on their own, but this creates a second lien on the property and doesn’t take advantage of the VA loan’s unique benefits.

Is There a VA Home Equity Line of Credit (HELOC)?

The VA doesn’t offer a home equity line of credit – or HELOC. While traditional HELOCs can be a great option for long-term home renovations, eligible VA loan borrowers could tap into their home equity with a cash-out refinance to get a lump sum upfront.

How We Maintain Content Accuracy

Our mortgage experts continuously track industry trends, regulatory changes, and market conditions to keep our information accurate and relevant. We update our articles whenever new insights or updates become available to help you make informed homebuying and selling decisions.

Current Version

Jan 14, 2026

Written ByChris Birk

Reviewed ByDon Wilson

Added data from the U.S. Department of Veterans Affairs to display VA cash-out refinance trends and add additional context for when cash-out refinances are a viable option.

Jan 28, 2025

Written ByChris Birk

Reviewed ByDon Wilson

Content fact checked and reviewed by underwriter Don Wilson.

Veterans United often cites authoritative third-party sources to provide context, verify claims, and ensure accuracy in our content. Our commitment to delivering clear, factual, and unbiased information guides every piece we publish. Learn more about our editorial standards and how we work to serve Veterans and military families with trust and transparency.

Related Posts

-

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them.

VA Renovation Loans for Home ImprovementVA rehab and renovation loans are the VA's answer to an aging housing market in the United States. Here we dive into this unique loan type and the potential downsides accompanying them. -

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.

Pros and Cons of VA LoansAs with any mortgage option, VA loans have pros and cons that you should be aware of before making a final decision. So let's take a closer look.